News

News Flash - May 2015

June 2015

Hello everyone,

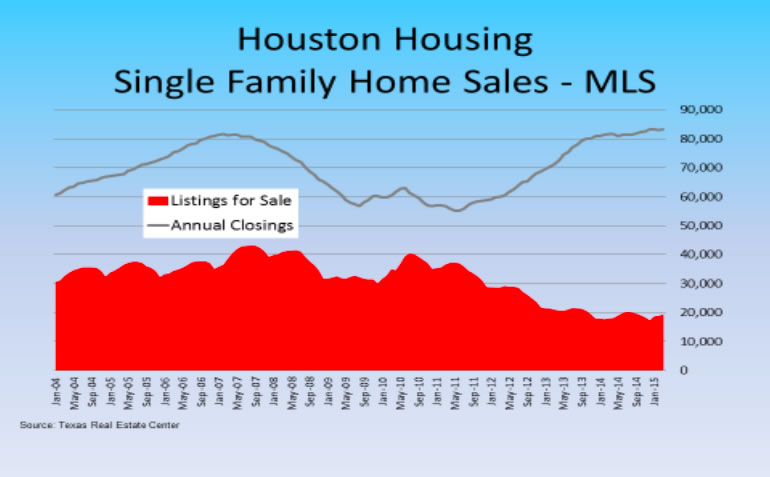

We are happy to report more good news about the Houston real estate market. Strong job growth over the past three years has led to high demand for housing and low inventories of all kinds. Houston Association of Realtors reported April 2015 sales were the highest on record. With historic-high levels of home sales, listing inventory is still very tight. If you are considering selling your home, be sure you know where you're going to move before putting your home on the market.

According to the April 2015 MLS Report released on May 13, 2015:

- Sales of single-family homes rose 1.9 percent year-over-year, with the greatest volume taking place among homes priced between $250,000 and $500,000.

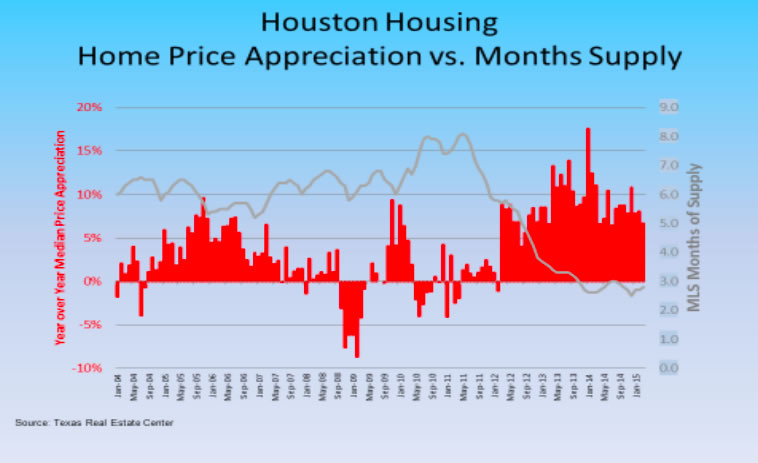

- Home prices achieved record highs for an April, with the average price of a single-family home climbing 4.3 percent year-over-year to $281,724. The median price-the figure at which half the homes sold for more and half for less-jumped 7.0 percent to $209,790.

- Months of inventory, the estimated time it would take to deplete the current active housing inventory based on the previous 12 months of sales, increased to a 2.9-months supply versus 2.6 months last April.

The general consensus seems to be that although there may be an impact from the oil price decline, the housing market in Texas should still be robust. Interest rates continue to be low and that will help to keep the market moving at a steady pace. The largest concern will be overcoming tight inventory. People will still be moving to Texas for jobs and will still need housing.

In addition, McAlister Investment Real Estate is excited to announce that we will be closing the McAlister Opportunity Fund 2014 to new investors on July 17, 2015. The 2014Fund has made exceptional acquisitions and has over $30 Million of very selective Land Banking and opportunistic investments ready for immediate acquisition. This window of opportunity to buy or Land Bank properties at discounted prices is available now while banks and lending institutions are largely absent from the market place.

Texas continues to experience strong job and population growth supporting the demand for new residential development. Despite the gloomy headlines, The Greater Houston Partnership has forecast Houston to have a healthy job growth of 60,000+ jobs in 2015 (in line with Houston's 10-year average) and build 30,000 new homes. The supply of lots and new houses is very short and this has created an ideal investment environment for the Fund.

By closing the Fund to new investors early, the Fund will benefit from:

- A shorter acquisition period which will expedite the sale of assets and distributions back to the investors.

- The shortening of the acquisition period creates a more rapid capital flow into the Fund and allows the Fund to make acquisitions of properties that have been cherry picked.

- A shorter capital raise will boost the personal rate of return on the investment. The sooner the Fund is able to make distributions and return capital back to the investors, the better the rate of return.

- The existing Land Banking investments in the Fund are set to sell property as early as November 2015, at which time the investors will be able to immediately begin receiving distributions. The business plan is that the Land Banking option will provide annual cash distributions to the investors.

- As capital comes in prior to the close date, the Fund will be able to purchase those investment properties that have already been identified for acquisition.

We look forward to a successful conclusion to the Fund's capital raise and to outstanding investment results created by the developer's need for capital and the short supply of new homes and lots.

Should you have any questions, please feel free to contact our office at (713) 535-2250.

David Jarvis

Executive Vice President

McAlister Investment Real Estate

Sources:

1 MLS Report for April 2015 - http://www.har.com/content/newsroom

The Opportunity

The lack of liquidity in the market, combined with continuing loan maturities, has created the "perfect storm" in many real estate markets in the United States.